Paycheck estimator calculator

Get Started With ADP Payroll. My net paycheck reduction.

Paycheck Calculator Online For Per Pay Period Create W 4

Multiply the hourly wage by the number of hours worked per week.

. This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Account value with 65 annual growth.

To change your tax withholding amount. Estimate garnishment per pay period. Salary Calculator The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

Well do the math for youall you need to do is enter the. Ad Create professional looking paystubs. Taxes Paid Filed - 100 Guarantee.

Money I put toward retirement. Use your estimate to change your tax withholding amount on Form W-4. Then multiply that number by the total number of weeks in a year 52.

GetApp has the Tools you need to stay ahead of the competition. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Ad See the Paycheck Tools your competitors are already using - Start Now.

Let us know your questions. Get 3 Months Free Payroll. Our Resources Can Help You Decide Between Taxable Vs.

Ad Compare This Years Top 5 Free Payroll Software. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Get 3 Months Free Payroll.

1 This calculation assumes that retirement plan contributions are deducted from. For example if an employee makes 25 per hour and. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty.

Get Started With ADP Payroll. Need help calculating paychecks. It can also be used to help fill steps 3.

For example if you earn 2000week your annual income is calculated by. Process Payroll Faster Easier With ADP Payroll. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. So your big Texas paycheck may take a hit when your property taxes come due. Some states follow the federal tax.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. This number is the gross pay per pay period. If you want to boost your paycheck rather than find tax.

Examples of payment frequencies include biweekly semi. Ad Calculate Your Payroll With ADP Payroll. Compare options to stop garnishment as soon as possible.

We use the most recent and accurate information. Subtract any deductions and. Enter your employees pay information.

Hourly Paycheck and Payroll Calculator. Process Payroll Faster Easier With ADP Payroll. Ad Calculate Your Payroll With ADP Payroll.

Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Ad See How Paycor Fits Your Business and Use Our Helpful Solution Finder Today. The state tax year is also 12 months but it differs from state to state.

Ad Takes 2-5 minutes. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Generate your paystubs online in a few steps and have them emailed to you right away.

Subtract any deductions and. California Paycheck Calculator Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and. How to calculate your paycheck This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

These numbers represent the median which. Or keep the same amount. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Enter your info to see your. Most employers use this paycheck calculator to calculate an employees wages for the current payroll period. How You Can Affect Your Texas Paycheck.

Ad Easy To Run Payroll Get Set Up Running in Minutes. The estimated total pay for a Estimator is 80803 per year in the United States area with an average salary of 64011 per year. This number is the gross pay per pay period.

After You Use the Estimator. Free Unbiased Reviews Top Picks. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

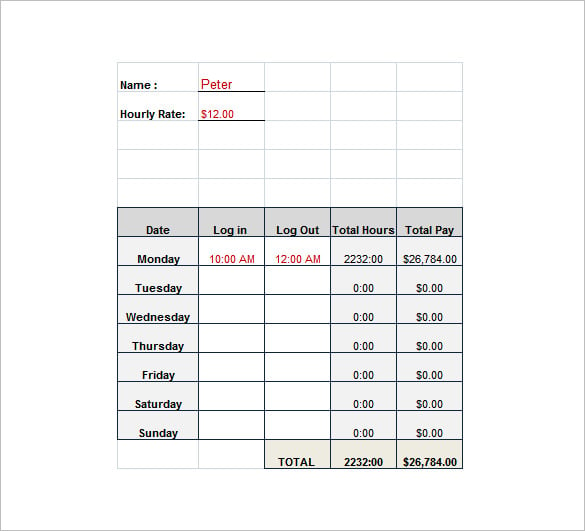

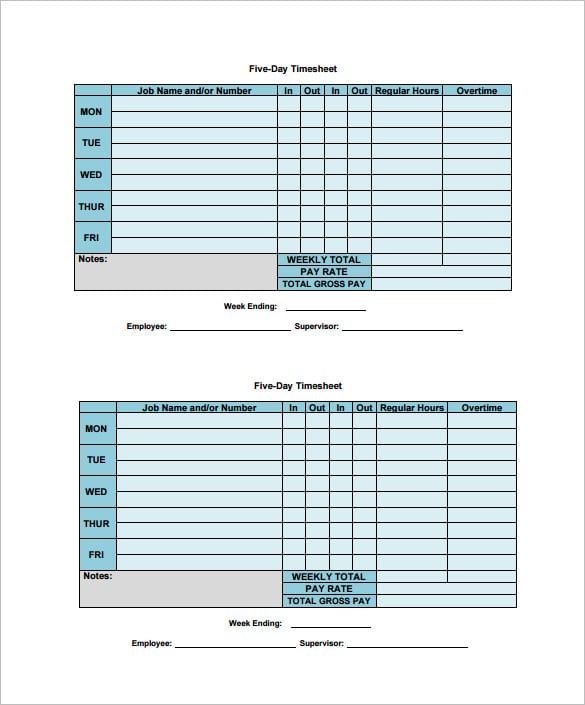

Payroll Calculator With Pay Stubs For Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Free Paycheck Calculator Hourly Salary Usa Dremployee

Hourly Paycheck Calculator Step By Step With Examples

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator Take Home Pay Calculator

Take Home Pay Calculator

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

7 Weekly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math